LUXURY REAL ESTATE OUTLOOK FOR 2025

A Luxury Real Estate Outlook for 2025

What design fads, economic developments, technology & amenity trends will shape the Real Estate Market in 2025

JUDITH SUTTON COLDWELL BANKER GLOBAL LUXURY SPECIALIST

A look forward and what to expect in 2025

Hopes are high for luxury housing next year, with central banks around the world still rolling back interest rates and the U.S. stock market forecast to continue rising.

That sense of abundance, at least for the wealthiest, can even be sensed in interior design trends, which have gone from austere and sterile to wildly colorful and full of personality in recent years. That will breed a new spin on maximalism that leads to the “more is more” mentality with increased focus, according to many design professionals. So, what is next in real estate? New luxury developments are on the horizon…to make your life easier in 2025.

First, how do you define luxury? A survey of new developments opening around the world in 2025 found that it is all about the experience of effortless, high-end living. (or you might say; very high living!) Let’s explore!

Yes, the finishes, appliances and smart technology are top of the line and worthy of five-star resorts, but privacy, spectacular views, and leisure-time pursuits, such as golf and boating, are equally important.

Quiet Lounges, Sport ‘Labs’ and Resort-Style Pools Lead 2025’s Home Amenity Trends

Sounds good! Sounds luxurious!

The bar for amenities will continue to rise in 2025 as developers work to transform the luxury residential experience. From saltwater pools to Roman bath-inspired wellness circuits in Florida’s newest premium towers, designers are creating immersive environments that merge wellness, technology, and sophisticated social spaces.

Five Factors That Could Make or Break Housing Markets in 2025

We’ve already seen the power of falling mortgage rates, tax-friendly policies and a strong stock market which is driving home purchases.

Much is poised to change across the world in 2025, with new and re-elected world leaders bringing policy ideas to the fore that will trickle into many aspects of life, not least housing markets.

All eyes are also on central banks across the globe and their movements on interest rates, and on equity markets, which are projected to perform with vigor. Both will have an outsized impact on real estate in the U.S. and abroad—with a robust stock market greatly benefiting the luxury sector. Most of the action will hinge on when and if those expectations come to pass and where.

There are more rate cuts to come, which is good, but until those rate cuts happen, there might not be a huge amount of room for price growth right now. We are waiting for cuts to come through in the new year, and that will unlock the market in a lot of locations.

Meanwhile, tax policies will continue to play an important role in where wealthy buyers want to live.

And not least, with the continued transfer of wealth from the silent generation and baby boomers to their millennial and Gen Z family members. The whims and wills of the younger generations will begin to reshape the demands put on luxury real estate across the world, not only those of us in the US.

These five factors will have the biggest effect on global luxury residential real estate across the world in 2025:

Interest Rates

The year ahead will likely see a continued easing of interest rates from central banks around the world, economists predict. It means that mortgage rates are likely to come down some as well, unlocking buying and selling in markets across the globe.

Earlier this month, U.S. Fed officials forecast their target rate at 3.9% by the end of 2025, with further cuts anticipated for 2026. Those figures are slightly higher than they previously anticipated, and Fed officials left open the possibility that it may not cut rates at all next year considering President-elect Donald Trump’s planned tariffs, which could reignite inflation.

We’re not going back to those very low, pre-pandemic interest rates. The prediction is that any lowering will spur an increase in real estate transactions after a hot period for rentals.

Further professionals forecast more sales of luxury real estate in 2025. The combination of pent-up demand from buyers sidelined by a lack of properties, an easing in mortgage rates, and luxury home pricing coming back down to 2019 levels will make buyers active in the market again.

Equity Markets

*After a year that bucked expectations, financial analysts are predicting another strong year of growth for equity markets. Goldman Sachs and Morgan Stanley forecast the S&P 500 could hit 6,500 by the end of 2025.

The equity market obviously has had a great year, and it is been a great source of wealth creation. If there is a significant pullback in the equity markets, could that affect luxury real estate? The answer is yes.

In the U.S., certain luxury markets like Aspen, Colorado; Park City, Utah; and Jackson Hole, Wyoming, will remain well insulated from any downturn.

The wildcard at large, he said, is to what extent Trump’s proposals that touch on housing become policy.

Ability to Do Business

Real estate in cities across the world with favorable tax policies are reaching new heights and are expected to continue luring high-net-worth buyers in 2025.

Still important for people who are looking to buy luxury homes, (often their second or third homes), they want a place that they can operate globally from and operate their business interests, highlighting good connectivity and the ability to hire skilled workers as major draws.

Generational Transfer of Wealth

Over the next decade, some $90 trillion is poised to change hands in the U.S. from the silent and baby-boomer generations to millennials and Gen Z, handing the reins to the younger generations to make decisions about where and how they spend.

It remains to be seen how wealthy millennials and Gen Z will stack up to their earlier counterparts when it comes to global property ownership.

It should create more transactions. We’re going to start seeing the kids sell their parents’ houses, and then they will buy something new for themselves. Example: That doesn’t mean that generational properties, like a chateau in France that’s been in the family for 200 years will sell, but their apartment in Paris will.

We are starting to see younger generations move away from renting for convenience, a pandemic-era trend, and move toward holding a small portfolio of homes.

Lots of wealthy families might have two, three, even four homes. Is that something which the next generation will want to continue, or do people find that a little bit complicated in terms of their lifestyle? There has been some evidence that there’s some reluctance from younger people to take on that kind of complexity of ownership and management of real estate portfolios.

Climate Resiliency

Climate change is a top concern for the next generation of buyers

One thing is for certain: Millennials and Gen Z prioritize spending differently than the earlier generations. They are putting a premium on climate and meaningful expenditures. Practicality seems to be the trend.

Some 66% of millennials focus on investing with purpose, compared with 49% for Gen X, and Gen Z might be taking it a step further.

Climate change is the No. 1 concern for Gen Z, and whether they’re rich or just affluent, they see it as their generational responsibility to fix what has been broken by their elders. (sure, blame it on us parents!) This issue is fundamentally changing consumer behaviors, particularly for those with wealth.

As younger buyers become wealthier, their climate-conscious focus will manifest a demand for energy-efficient homes and solar power. The industry needs to listen.

This climate awareness will also likely influence where the younger generations are buying homes in years to come.

Why would I buy in Miami? If it is going to be underwater in 30 years? Denver, Boulder and Vale are a very sought-after area and a location forecast to weather the effects of climate change with more gusto than coastal properties.

Also, real estate in Cleveland, Ohio, has doubled in value over the past few years, with the area rated in 2023 by National Geographic as one of the most resilient cities weathering climate change.

In 2025, as millennials and Gen Z continue to become a larger share of homeowners, we will likely continue to see more climate-resilient destinations grow in popularity, and with them the demand for more energy-efficient homes and green-home infrastructure like solar panels. Let the Buyer be aware!

.jpg)

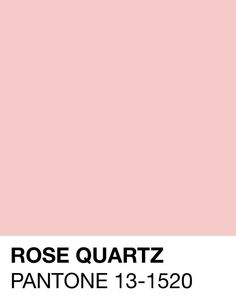

Declaring Rose Quartz “a persuasive yet gentle tone that conveys compassion and a sense of composure, the color company later went on to cast Pale Dogwood — a closer match to Millennial Pink — among its top 10 colors to watch on its

Declaring Rose Quartz “a persuasive yet gentle tone that conveys compassion and a sense of composure, the color company later went on to cast Pale Dogwood — a closer match to Millennial Pink — among its top 10 colors to watch on its  “Every female client of mine over the past one to two years has come to me seeking a full pink or blush look for their home,” says the fellow millennial decorator. “I just completed an entire home in solely dusty pink velvet, white and rose gold. Pink tones are becoming the new neutral in design. I can’t name a recent project that I haven’t used a pop of pink for!” (again, I mention the pink bedroom in the Mansion in May!)

“Every female client of mine over the past one to two years has come to me seeking a full pink or blush look for their home,” says the fellow millennial decorator. “I just completed an entire home in solely dusty pink velvet, white and rose gold. Pink tones are becoming the new neutral in design. I can’t name a recent project that I haven’t used a pop of pink for!” (again, I mention the pink bedroom in the Mansion in May!)